8 min read

Key takeaways

- Having the right insights into your customers and their evolving payment preferences is critical to making more informed decisions and better managing your bottom line.

- Gathering this data can be both complex and time-consuming. And, if the data isn’t available or reliable, it can mean wasted resources and missed opportunities.

- Based on learnings from more than six years of serving direct-to-consumer firms with bespoke insights, our Customer Insights solution can help you get more accurate data in less time.

Contributors

Florencia Ardissone

Head of Customer Insights J.P. Morgan Payments

Today, the need to harness data and insights is no longer a maybe. It’s a must.

Knowing your core customers—when, where and how they purchase, how to best reach them, and understanding your peers—can make or break your business. In fact, obtaining and examining these large data sets has become an indispensable tool for businesses of all types and sizes, helping increase growth by building virtuous ecosystems and enabling aggregated, de-identified privacy-compliant insights sharing to help support strategic decisions. And generating these insights in a privacy-compliant way is a priority.

Ultimately, you need to meet customers where they are to support every step of their purchasing adventure, creating a seamless experience between digital and physical channels.

The challenge: Doing so is not only difficult, it’s also time-consuming. That is where our J.P. Morgan Customer Insights solution can help.

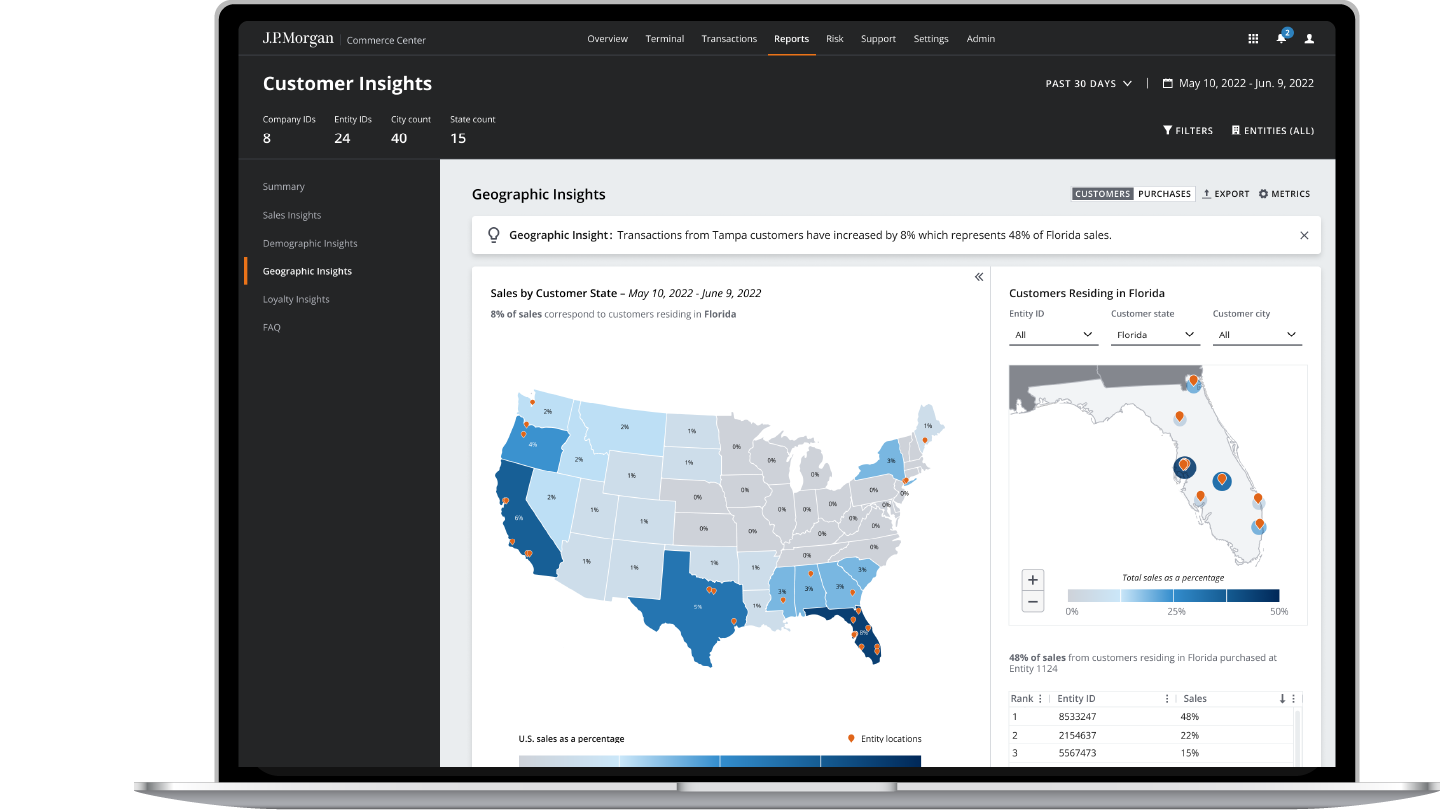

Guide marketing and location strategies with geographic insights

In order to focus your marketing or choose the best location for your next brick-and-mortar store, you need to define who your customers are and where geographically they concentrate. What is their average ticket? What is the share of new and repeat customers? At what times do customers purchase? What is the share of locals vs. tourists? The answers to all of these questions and more can help you tailor your decision-making.

For example, you can quickly identify geographic areas with a high concentration of potential customers and no retail presence. It can also highlight opportunities to close low-performing stores when customers are willing to travel distances to make purchases. Plus, by monitoring your customers’ migration over time, you can see if marketing efforts are working as intended and identify new customer acquisition trends month-over-month for a given store, city or state.

“Customer Insights helped us shed light on client (...) purchasing characteristics. This data was useful in regard to our digital strategy and marketing messaging with the acquisition of new customers.”

Zachary Moscot

Chief Design Officer, MOSCOT

Invest smarter with benchmarking insights

Investing in the future of your business is important. But making the right investments can be a game-changer. Because when you know what’s working for you—and your peers—it can guide your investments toward significant growth opportunities.

Backed by one of the world’s largest payments processors,1 our Customer Insights solution provides the benchmarking data assets that can give you a clear view of how businesses like yours are doing, what’s working for them, and how that can guide your investment decisions. It pinpoints customized peer benchmarking—organized by regionality, industry, etc.—so you can take next steps to help your business thrive.

“We are very thankful (…) the detailed analysis of spend in U.S. cities provided valuable input to confirm our U.S. boutique rollout plan and highlight new areas of interest. We will soon be opening a Breitling boutique in San Francisco and are pleased to see San Francisco on top of the ranking.”

Olivier Smekens

Head of Treasury, Breitling

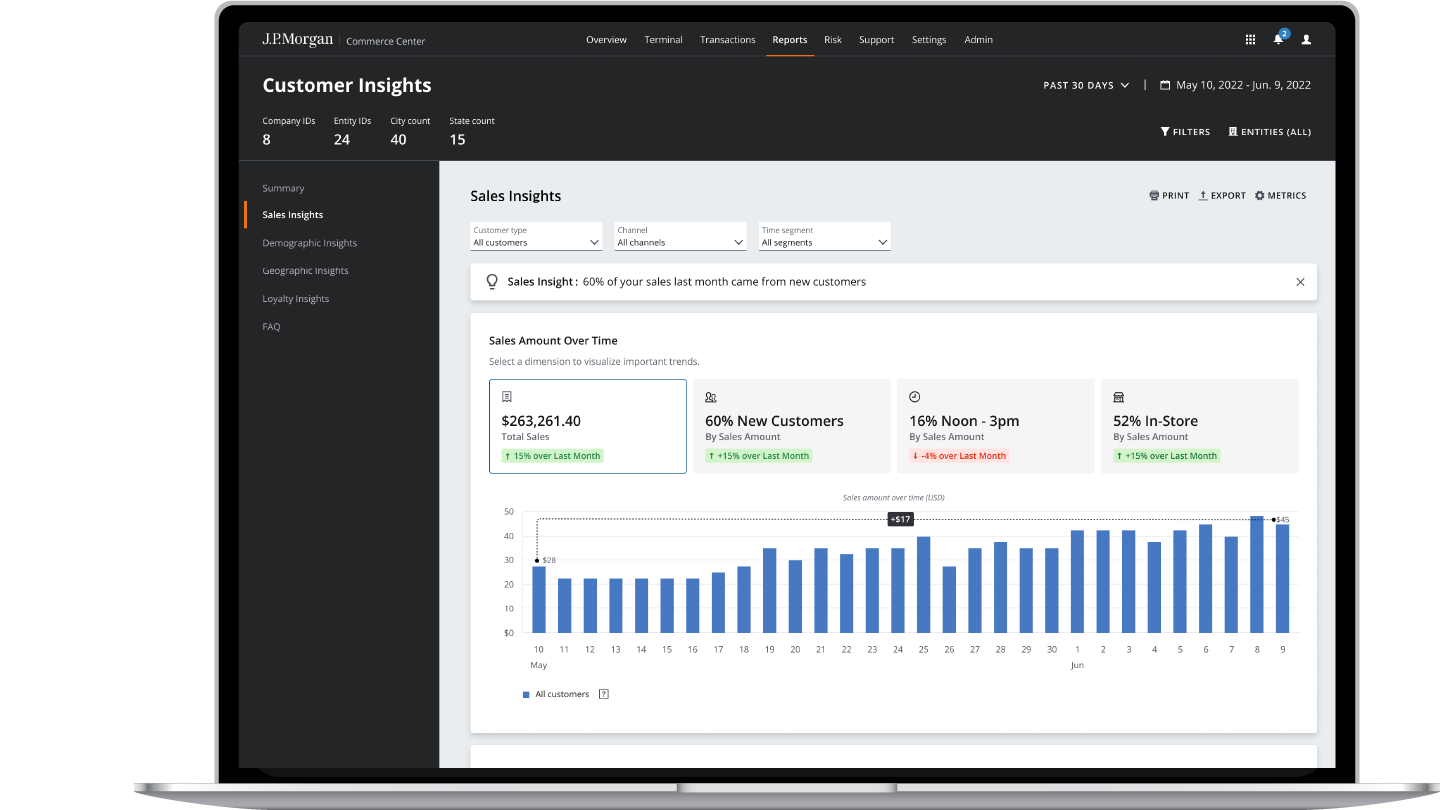

Optimize store operations with sales insights

Operational efficiency is at the heart of every successful organization, and customer insights and data analytics are powerful tools with the potential to yield substantial benefits. These benefits include cost savings, increased customer satisfaction and enhanced competitiveness.

In addition, with near-real-time tracking of sales by channel, new and repeat customers, and time-of-day by store, you can also optimize your staffing and opening hours.

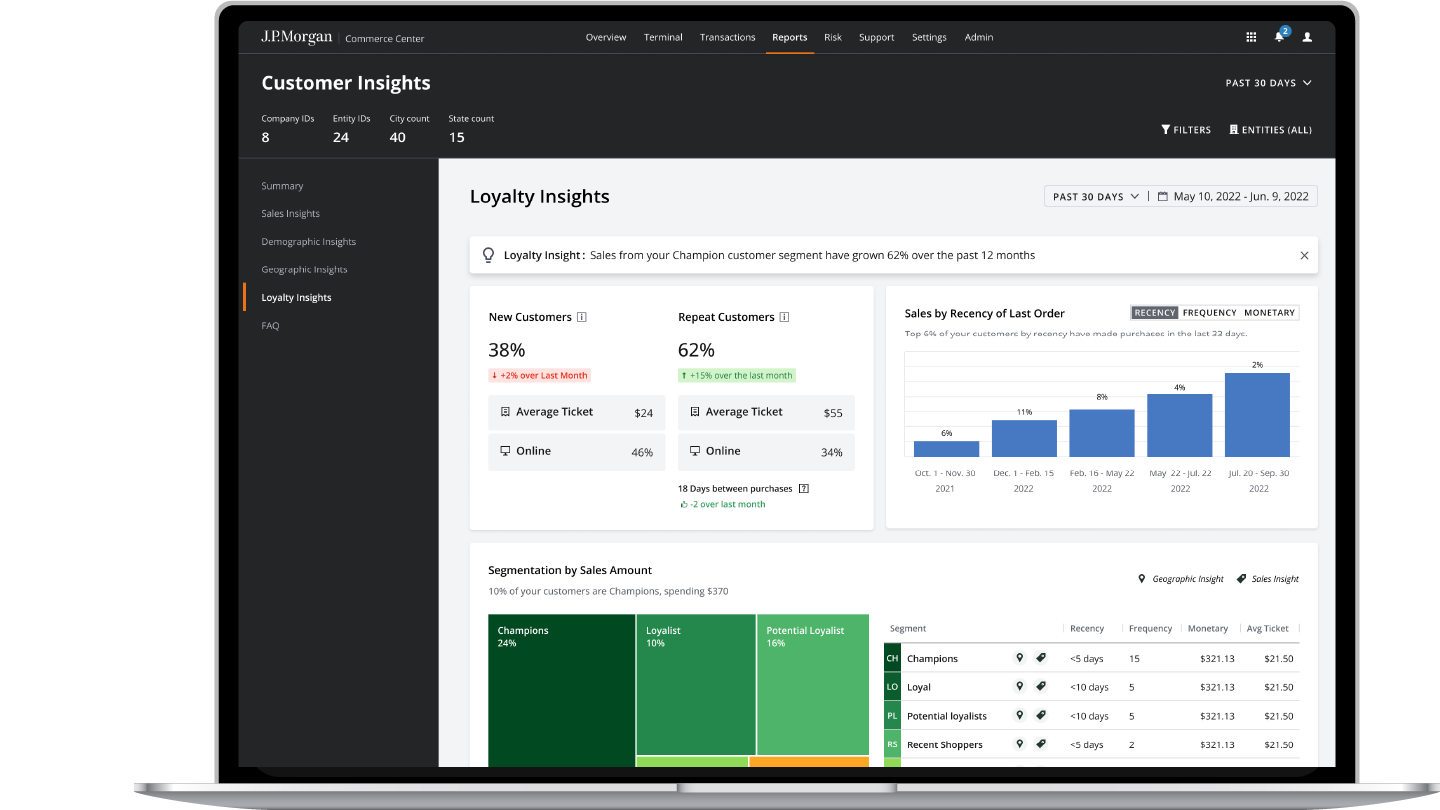

Boost customer lifetime value with loyalty insights

Customer loyalty. It’s all about the relationships you build with your customers based on every interaction they have with your product, service, marketing and more.

This unique relationship means any experience of any kind that a person has with a brand can either enhance loyalty or have a negative impact on it. Through the use of our Customer Insights solution, you can maintain a well-rounded understanding of your customers’ lifetime value and repeat purchase patterns to help tailor and boost loyalty. Plus, adopting an omnichannel strategy offers a consistent, cohesive experience across both digital and brick-and-mortar touchpoints.

“Customer Insights provides valuable input into the crafting of our strategies to recruit and retain new customers, while also increasing loyalty through increased frequency of purchase.”

Paul Davies

Chief Financial Officer, Tory Burch

The bottom line . . .

Your goal is to grow your business successfully. Ours is to synthesize the data into insights to make it happen.

Decision-making based on facts can empower your business to guide strategic and operational decisions. It supports operational excellence, so you can adapt quickly to evolving challenges and take advantage of opportunities in today’s fast-changing business environment.